06 sept. D&B’s Latest Global Economic Report: Signals of a Changing Market Landscape

Download in PDF format for free!

(Content of D&B)

Global Economic Changes Impact on Business

Multiple worldwide disruptions over the past three years have contributed to an unprecedented environment, creating nuances that can be difficult to understand without historical commercial business data and timely, sophisticated analysis. The business ecosystem is experiencing continued challenges that carry with them compounding effects, and many public sector regulatory bodies are attempting to quell uncertainty through monetary policy to support economies facing crisis. These may be the warning signs of global economic headwinds, including:

- Rising failure and delinquency scores signaling mounting pressure on already distressed entities

- Continuing disruption in operations

- Deteriorating small business health

- Increasing business fraud innovations

Further, Dun & Bradstreet’s risk scores predict signs of a changing economy and a potential slowdown due to inefficiencies in procurement and elevated logistics and input costs, among other factors.

These findings, along with the following observable trends, additional examples, graphs, and Dun & Bradstreet data, are explored and defined in more detail in the full Global Business Economic Report.

Observable Trends

Operational Disruption Will Continue

Clustering metrics revealed a decrease in available entities with common characteristics suggesting some significant impact to global operations and resulting in cross-border commerce.

Rising Failure and Delinquency Scores Signaling Mounting Pressure on Already Distressed Entities

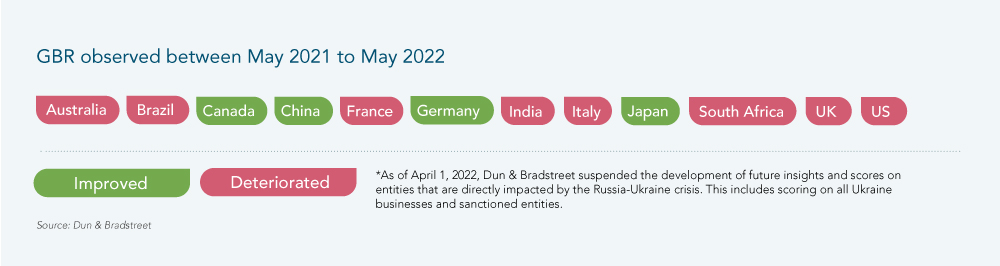

The Dun & Bradstreet Global Business Ranking (GBR), which predicts the likelihood that an organization will become inoperable, inactive, or dormant in the next 12 months, has deteriorated in key markets such as the U.S., U.K., France, and India (GBR observed between May 2021 and May 2022). A deterioration in this score implies a higher risk for an entity to become inactive. This also demonstrates that the impact of multiple disruptions are indeed vast, and the ripple effect may impede growth in the near-term.

Deteriorating Financial Health Signs Across Several Small Business Sectors

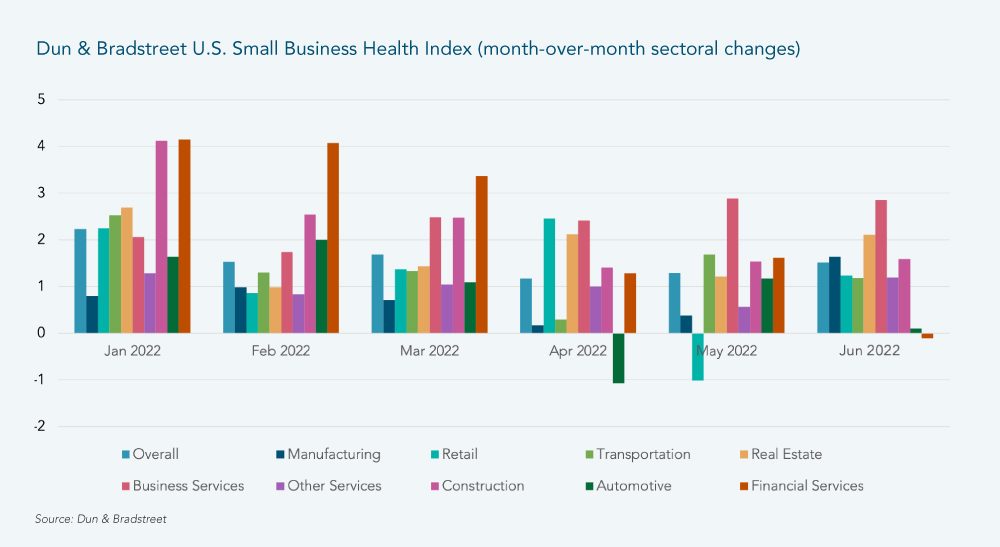

The Dun & Bradstreet Small Business Health Index (SBHI) in the US, which is strongly correlated to economic activity, shows continuous deceleration in growth within some major sectors beginning as early as 2022 and through to June 2022.

Increasing Business Fraud Innovations Brought on by an Increase in Cash Flow Constraints

In Q3 of 2022 (partial quarter), Dun & Bradstreet’s team of certified fraud examiners who investigate occurrences of malfeasance, including misrepresentation or identity theft of an organization, has observed an increase in misrepresentation cases as well as an increase in business identity theft when compared to Q3 of 2021.

Conclusion

The rise in costs, diminishing availability of suppliers, deteriorating financial health of small businesses, and consumers turning toward services rather than purchasing new durable goods will all have a negative impact on margins, raising the risk of insolvencies of organizations.

Has your company considered its long-term strategy to weather potential changing market conditions? Learn more about the warning signals, what they might mean for your organization, and best practices to help you prepare for this unprecedented combination of events.

Download the full Global Economic Report now and learn more about countries’ payment practices